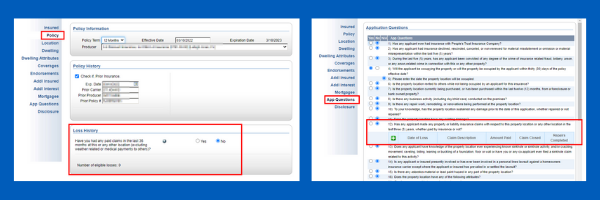

CRITICAL REMINDER: ASK APPLICATION QUESTIONS

Underwriting has alerted us to an increased amount of incorrect information on new business applications. As a result, policies are being canceled.

It is paramount to ask, and thoroughly review, each and every question on the underwriting application for insurance on every risk you submit. The application questions are material to the underwriting and acceptance of a policy.

Not disclosing prior claims history will result in the cancellation of the policy and can void policy coverage.

We want to avoid unnecessary cancellations whenever possible, so please remember to review all questions and include ALL losses within the last 36 months, even when weather-related or from previous addresses.

Thank you for your assistance.

TOP PRODUCERS RECEIVE MILLION DOLLAR PAINTINGS

Congratulations to our million and multi-million in-force homeowners insurance premium producers. We continued our tradition of recognizing the effort that goes into this level of production with our calendar-themed paintings that we personally hand-delivered in February and March on behalf of People’s Trust Insurance President and CEO George W. Schaeffer.

We truly appreciate the hard work of these exceptional Agency Partners that goes into becoming a million-dollar agent.

ACCESS KEY FILES WITH EASE, 24/7

The My Account Portal gives you on-demand access to the latest agency-specific documentation you need, including:

- Bi-weekly retention: Policies Pending Cancellation for Failure to Comply with Home Inspection

- Bi-weekly retention: Policies Pending Cancellation for Nonpayment

- Monthly Commission statements

- Monthly Consent to Rate DNR policy lists

- Monthly Agency Experience and Production reports

… And more! To see it all, just login and head to the FILES tab to locate the applicable documents. If you need help accessing My Account, contact Agency Support by email or call us at 561-235-7004.

| Go to My Account Portal |

UNDERWRITING GUIDELINES UPDATE

If you missed the last newsletter, here’s a key reminder. We’re currently allowing a select number of agency partners to write new business with us! However, some Underwriting guidelines have changed. If your agency is interested in reopening for new business, please complete our Binding Authority Request Form.

Please note that the following counties remain closed for new business: Seminole, Osceola, Lake, Orange, Miami-Dade, Broward, Palm Beach, and Monroe.

The most important underwriting changes are related to roofing systems, prior insurance, and documentation. For roofs, the age guidelines are now:

- Tile/Metal: 25 years (20 years in Tri-county)

- Shingle 15 years (10 years in Tri-county)

- Flat (over living area): 10 years (all of Florida)

We now require a final roof permit to verify the age of the roofing system. Additionally, we no longer accept a lapse in coverage of over 45 days or force-placed insurance — so proof of purchase or prior insurance must be provided. Lastly, all required documents must be uploaded in PTS within 21 days of the effective date to avoid cancellation. For all current Underwriting guidelines, check out our UW Snapshot. As always, the most up-to-date version can be found on our website so we recommend bookmarking this page.

Still have questions? We’re hosting several live, 15-minute refresher training sessions to go over these recent changes. Should you or anyone on your team wish to participate, please register here.

My Account Login

My Account Login